Obtaining a bank loan can be a key step toward achieving goals such as purchasing a home, financing studies, or starting a business. However, many Colombians face rejection or unfavorable terms simply because they don’t know the requirements, the best options, and how to prepare.

In this guide, you’ll discover how to responsibly obtain a bank loan in Colombia, what factors banks review, examples of current products, and specific tips to improve your chances.

What is a bank loan and how does it work in Colombia?

A bank loan is a loan that a financial institution grants under agreed conditions (term, interest rate, guarantees) so that the applicant receives an amount that must be repaid plus interest.

Financial institutions in Colombia evaluate several factors before approving a loan:

- Credit history : how you have managed previous debts.

- Stable income and ability to pay : demonstrate that you can afford the payments without risk.

- Guarantees or endorsements , depending on the type of credit.

- Age, nationality and residence : each bank defines permitted ranges.

- Type of credit : free investment, consumption, housing, vehicles, mortgage, etc.

For example, Banco Agrario offers a Free Investment Digital Credit , approved and disbursed online, with clear requirements such as minimum income, seniority, and no negative reports from credit bureaus.Agrarian Bank

In the case of housing, Bancolombia requires documents such as income and withholding tax returns, tax returns, or financial statements, as appropriate.Bancolombia

For personal loans, Banco de Occidente requires an ID card, employment letter, pay stubs, and length of employment.Bank of the West

✅ Benefits of accessing a well-used bank loan

- Access to important assets or projects : from housing to education or ventures that require investment.

- Improve your credit history : Paying off your loan well generates a good credit report and opens the door to larger products.

- Competitive rates and reasonable terms : If you have a good profile, you can get lower rates and affordable installments.

- A variety of products : free investment loans, housing loans, vehicle loans, consumer loans, etc., tailored to different needs.

- Fast digital processes : More and more banks are allowing applications to be processed online, without lines or paperwork. (e.g., digital credit from Banco Agrario)

🛠 Steps to get a bank loan in Colombia

Here’s a step-by-step plan you can follow:

- Evaluate your credit needs and type.

Define what you need the loan for: housing, non-refundable loans, consumer loans, or vehicle loans. This will guide you through the specific requirements. - Check your credit history and score.

Consult your information with credit bureaus like Datacrédito or Procrédito to detect any negative reports you can resolve.

Having a good score (for example, above 580 on some scales) improves your chances - Calculate your debt capacity.

Banks review how much of your income can be used for credit. If you already have high debts, they’re likely to turn you down. - Choose the right financial institution.

Consult commercial banks, cooperatives, public entities such as Banco Agrario, etc. Compare offers, rates, and terms.

For example:- Banco Agrario : free investment digital credit with online approval

- Banco AV Villas : loans without negative reports and with clear requirements

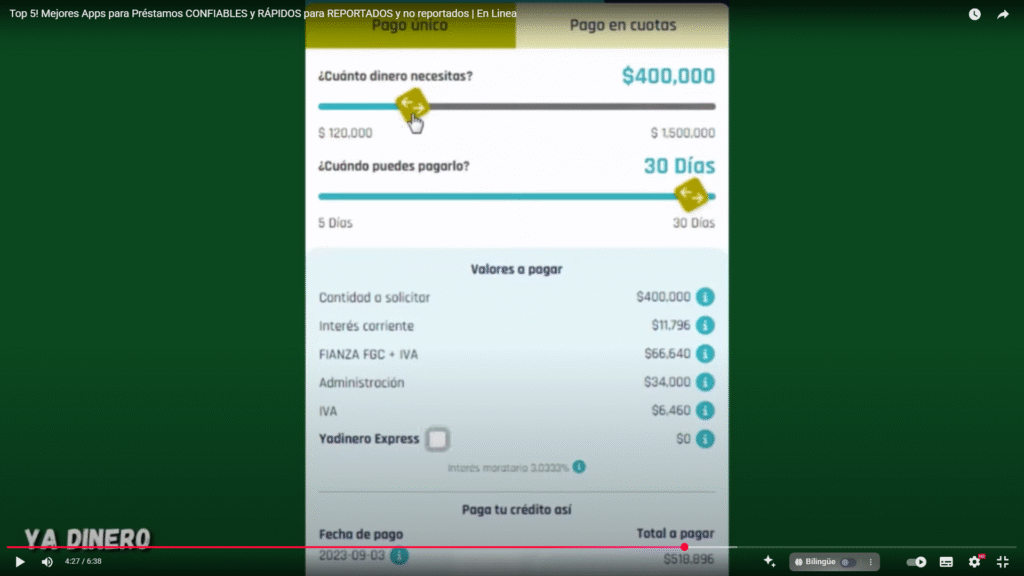

- Banco Caja Social : free investment credit with a minimum income of 1 SMMLV and terms of 6 to 60 months

- Prepare the required documentation

Although it varies depending on the credit, you will often need:- Citizenship card (or foreigner’s document)

- Employment certificate, pay stubs or income certifications

- Income tax return or income certification if you are self-employed

- Financial statements if you apply as a company

- Guarantees or endorsements in special cases

- Submit the application and follow up

. Complete the official form (online or in person).

Track the status of your application, respond to the bank’s requests, and await the decision.

If approved, carefully review the contract before signing.

💡 Helpful tips that can make a difference

- Improve your credit profile before applying : pay off small debts, avoid late payments, and keep your credit card balances low.

- Don’t overpay unnecessarily : paying for less time can reduce your overall interest.

- Negotiate rates if you have a strong profile : Present your track record, stability, and other offers to request better terms.

- Avoid external payments : Require that all transactions be made within the official financial institution to prevent fraud.

- Check bank-specific age limits and policies : some banks allow up to 75 or 84 years for loans.

- Take advantage of digital products : banks are promoting online loans, which are faster and less complicated (Banco Agrario is an example)

- Consider housing subsidies or government programs : In some cases, you can combine credit with subsidies to improve your living conditions.