The cryptocurrency market is entering a decisive phase. October saw altcoins reach levels not seen since 2021.

According to analysts in the crypto ecosystem, the current scenario could represent the last opportunity to acquire digital assets at low prices before a sharp revaluation towards the end of the year .

Market sentiment has shifted. After months of consolidation, the US Federal Reserve’s policies—which continue to cut interest rates—are generating a renewed influx of liquidity into risk assets. Traditionally, the end of the year tends to be a positive period for financial markets, and this time the crypto space seems to be no exception.

A market in full swing

The specialized channel Criptofuturo warns that the ecosystem is in the final stretch of the accumulation cycle . Retail investors and whales are beginning to move more aggressively toward projects with solid fundamentals, especially in highly innovative sectors such as on-chain futures protocols , platforms , and blockchain .

The current focus is on one key narrative: the complete decentralization of trading . Protocols have gained ground against centralized exchanges, driven by demand from users seeking non-custodial, KYC-free, and faster trading .

Hyperliquid (HYPE): The New Giant of Decentralized Trading

One of the most talked-about names in this trend is Hyperliquid (HYPE) , a blockchain perpetual futures platform . Its ecosystem has grown exponentially thanks to a robust token buyback and burn model, a highly technical team, and an incentive structure that encourages mass adoption.

The launch of the HIP3 update has been a turning point: now, any developer can create their own perpetual futures application simply by locking up HYPE tokens. Furthermore, the service’s integration into the bill ,

With a return of over 1,000% year to date , HYPE is

For me, not including HYPE in a high-performance portfolio would be a strategic mistake , considering its dominant position in the DeFi trading sector .

Pump.fun (PUMP): The engine of meme euphoria

Another player attracting attention is Pump.fun (PUMP) , the leading platform for launching meme coins on the Solana network.

If the return of the so-called “meme season” is confirmed, PUMP could be one of the most benefiting tokens , representing direct access to the capital inflow that typically drives these types of coins.

Although the project generates controversy—given the number of worthless memecoins emerging daily—Pump.fun has innovated with automatic buyback models and live streaming that attract thousands of users.

During periods of high euphoria, buying pressure remains constant, which has turned the PUMP token into a speculative instrument with high potential, but also high risk.

The rise of decentralized stablecoins

While traders are betting on volatile tokens, another sector is gaining traction: stablecoins .

Emerging projects like Plasma (XPL) have surprised the market by offering ultra-fast, fee-free transfers between different stablecoins, attracting over $5 billion in value locked (TVL) .

However, its growth has been accompanied by controversy.

Some analysts claim that the “commission-free” operations are being funded by the team’s token sales, something that has been officially denied but continues to raise concerns.

Despite the volatility, XPL is backed by Tether and Bitfinex , two major players in the industry, positioning it as a potential hidden gem for the coming months.

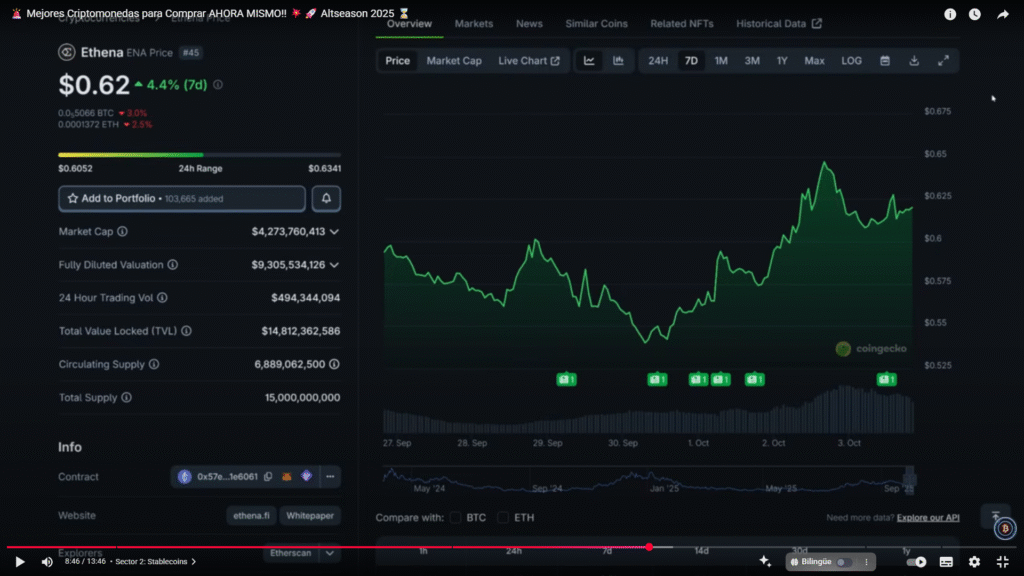

Another prominent project in this sector is ENA , creator of the USDE stablecoin , which already has nearly $15 billion in circulation and is growing at a record pace. Its success is based on reward systems for staking users , consolidating its position as one of the most innovative alternatives on the market.

Ethereum, Solana, and Avalanche: The Networks Defining the Future

In the field of smart contract blockchains , the major players maintain their dominance.

Ethereum (ETH) continues to attract institutional interest for its security, decentralization, and robustness, while Solana (SOL) is gaining ground among meme coin developers and high-yield projects.

Meanwhile, Avalanche (AVAX) , boosted by the announcement of a company that will be listed on Nasdaq and plans to accumulate tokens starting in 2026, is positioning itself as another undervalued network with strong upside potential.

Cosmos (ATOM) technology is also seeing a resurgence in this context, thanks to its recent airdrops and cross-chain interoperability, which could revitalize its ecosystem and attract new investors.

A season of euphoria on the horizon

With multiple narratives in play—from the resurgence of meme coins to the growth of futures DEXs —the crypto market is preparing for a potentially historic close to the year.

The overall sentiment is one of moderate optimism: global liquidity is increasing, technical fundamentals remain solid, and large investors are once again taking a closer look at the sector.

However, volatility remains the key factor . Experts recommend caution, diversification, and thorough analysis before investing. While some altcoins could multiply in value, others could continue to fall or disappear altogether.

Seize the moment

October could mark the last opportunity to strategically position yourself before a new global bullish momentum .

For investors willing to take controlled risks, projects like Hyperliquid, Pump.fun, ENA, and Avalanche represent real opportunities within a reawakening ecosystem.

The message is clear: the market is already moving.

Those who act with information, analysis, and strategy could be part of the next big crypto rally.