Pressure on the Federal Reserve mounts as construction costs soar and housing remains unaffordable for millions of Americans.

In a context marked by over-priced infrastructure projects, historically high interest rates, and an economy that, although vibrant, faces significant challenges, there is a growing urgent call for the Federal Reserve to lower interest rates to revive housing access and curb financial overruns in public construction .

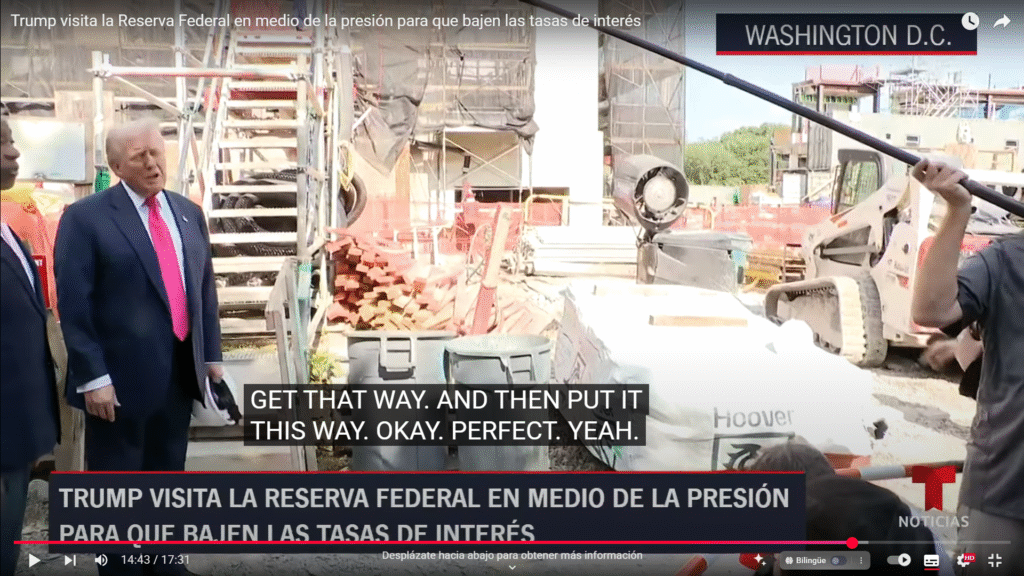

During a recent visit to the construction site of the new Federal Reserve headquarters—a project already approaching $3.1 billion in investment—former President Donald Trump expressed concern about the costs , the unnecessary complexity in the project’s execution , and the inability of many families to access housing . The construction, which includes up to a third building in the plan, has been heavily criticized for the mishandling of funds and the long deadlines.

This scenario has sparked a national conversation about how high interest rates are affecting not only public projects but also the opportunities for economic development and social stability for millions of citizens.

What does a high interest rate mean for the economy and citizens?

Interest rates are a key instrument for regulating the economy. When they are high, access to credit becomes more expensive, affecting businesses, consumers, and even the government. According to recent statements, each additional percentage point in interest rates represents more than a billion dollars in additional costs for the country .

This situation is hitting young couples and families trying to buy their first home particularly hard. As Trump noted during his tour of the Federal Reserve’s construction site:

“Our country has the most vibrant economy in the world, but people can’t afford to buy a home because of interest rates.”

He also highlighted that countries like Switzerland and Japan have substantially lower rates, allowing them to grow more flexibly. Meanwhile, the United States—despite receiving record revenues thanks to tariffs and international agreements—is failing to translate this momentum into more affordable conditions for its citizens.

Key benefits of lower interest rates

1. Wider access to housing

One billion Americans are buying their first home , especially

2. Multi-million dollar savings in public construction

by optimizing projects such as the Federal Reserve , which currently represents excessive spending.

3. Stimulation of employment and wages

With new sources of employment and upward pressure on wages due to talent competition.

4. Greater economic dynamism

An EC attracts foreign investment , strengthens

5. National Debt Relief

Reducing interest rates could mean annual savings of more than $1 trillion in interest alone, freeing up resources for social programs, infrastructure, or reducing the fiscal deficit.

What can be done to push for a rate cut?

1. Pressure

Political leaders and citizens must jointly express their concern about the effects of high rates on everyday life.

2. Prioritize access to housing on the national agenda.

Making this a priority can accelerate adjustments. No government wants to be responsible for preventing families from accessing decent housing.

3. Implement controls and audits in public works.

Avoiding waste in construction projects such as the Federal Reserve headquarters would allow funds to be redirected toward projects with a more direct social impact.

4. Strengthen trade agreements with tax benefits

As or neg , without af

5. Real

L Hundreds of billions of dollars raised could be used to subsidize mortgage loans or incentivize real estate development.

Practical recommendations for citizens and decision-makers

- Request clear information about mortgages : Despite current rates, there are options such as subsidized fixed rates or programs for first-time buyers.

- Participates : Organiz

- Apo : Fomen

- Promotes greater transparency in the execution of works : Exi

Me

The US economy has shown remarkable dynamism, with fiscal surpluses and sustained growth. However, the challenge is not only to maintain this pace, but to democratize its benefits . Lowering interest rates is not simply a technical or financial issue: it is a strategic decision for the well-being of millions of families , for the efficiency